401k 2025 Catch-Up Limits Roth - 2025 Roth Ira Contribution Limits Allix Violet, In 2025, the max is $23,000. You cannot deduct contributions to a roth. 2025 401k Contribution Limits Roth Mady Sophey, That means a total of $30,500. The limit on total employer and employee contributions for 2023.

2025 Roth Ira Contribution Limits Allix Violet, In 2025, the max is $23,000. You cannot deduct contributions to a roth.

401k Limits 2025 Catch Up Age Birgit Steffane, Here are the 2025 401k contribution limits. The 2025 combined limit for employee and employer contributions is $69,000 for those under 50 and $76,500 for those 50 and older.

401k 2025 Catch-Up Limits Roth. This dollar amount is the same as in 2023. Roth 401 (k) income limits + contribution limits [2025] anyone with access to a roth 401 (k) account can contribute, regardless of their income.

Total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

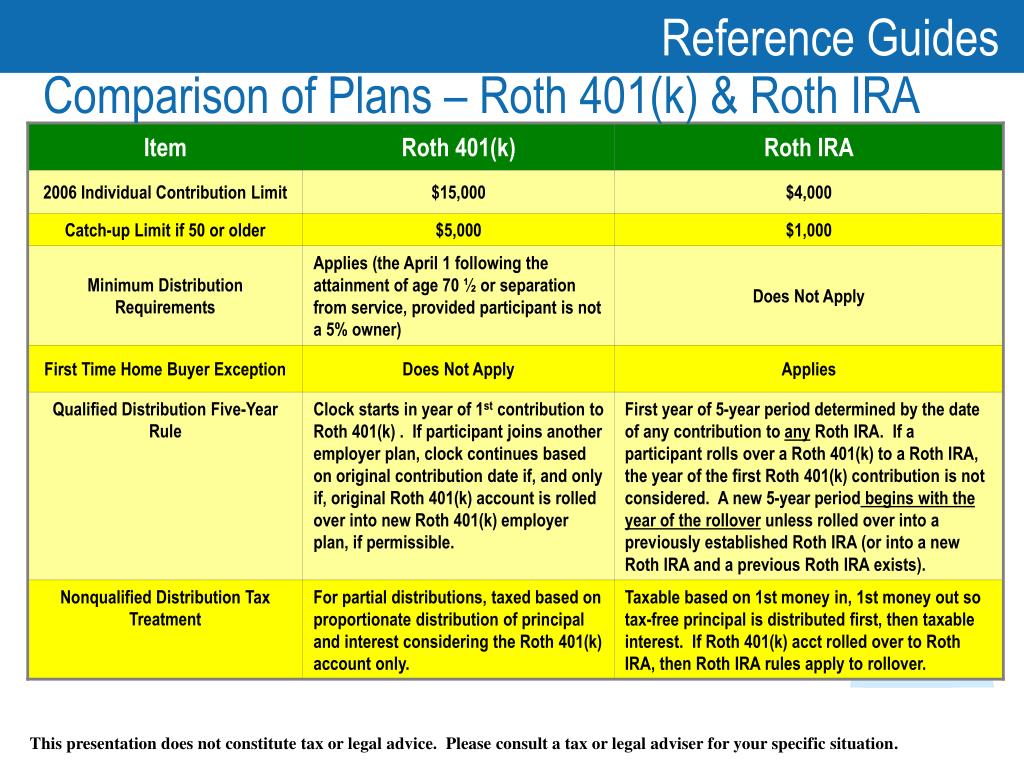

PPT Understanding the New Roth 401(k) PowerPoint Presentation ID510897, This dollar amount is the same as in 2023. Total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

2025 Roth 401k Limits Moira Lilllie, Can i max out both my 401 (k) and roth 401 (k)? Total 401(k) plan contributions by an employee and an employer cannot exceed $69,000 in 2025.

The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

The employee deferral limit increased by $1,000 and the.

401k 2025 Contribution Limit With Catch Up Aggy Lonnie, A roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Here are more details on the contribution limit and how you can take advantage of this unique retirement account.

Roth 401k Limits 2025 Alicia Kamillah, So if you earn at least $8,000 in 2025, you'll be able to contribute the full amount. The employee deferral limit increased by $1,000 and the.

401k Contribution Limits 2025 Catch Up Over 50 Dacy Rosana, Limits for those under age 50 went up by $3,000 for traditional and roth 401 (k)s and $1,500 for simple 401 (k)s. Can i max out both my 401 (k) and roth 401 (k)?